Capital One Extension: Your Comprehensive Guide to Payment Flexibility

Navigating financial obligations can be challenging, and sometimes, unexpected circumstances require a bit more time to manage payments. If you’re a Capital One cardholder facing such a situation, understanding your options for a “capital one extension” is crucial. This comprehensive guide will delve into the various ways Capital One provides flexibility, from balance transfers and payment plans to hardship programs and other support measures. We aim to provide you with the knowledge and confidence to make informed decisions about managing your Capital One credit card account.

This article isn’t just a collection of facts; it’s a resource built on expert understanding and a commitment to helping you navigate the complexities of credit card management. We’ll explore the nuances of each option, providing insights and practical advice to help you choose the best path forward. Whether you’re looking to consolidate debt, manage unexpected expenses, or simply gain more control over your finances, this guide will equip you with the information you need.

Understanding Capital One’s Approach to Payment Flexibility

Capital One understands that life happens. They offer several ways to help cardholders manage their payments, recognizing that financial stability can sometimes be unpredictable. These options aren’t just about extending deadlines; they’re about providing genuine support and empowering customers to regain control of their financial well-being.

Capital One’s approach to payment flexibility is multi-faceted. It includes:

* **Balance Transfers:** Transferring high-interest debt to a Capital One card with a lower APR can save you money and simplify your payments.

* **Payment Plans (e.g., My Credit Steps):** These plans allow you to break down large purchases into smaller, more manageable monthly installments.

* **Hardship Programs:** In times of genuine financial difficulty, Capital One may offer temporary assistance programs to help you get back on your feet.

* **Direct Communication & Support:** Capital One encourages open communication. Contacting them directly to discuss your situation can often lead to personalized solutions.

These options reflect Capital One’s commitment to responsible lending and customer support. They’re designed to provide a safety net for cardholders facing temporary financial challenges.

Exploring Balance Transfers for a Capital One Extension

One of the most effective ways to gain more time and control over your debt is through a balance transfer to a Capital One card. This strategy involves transferring high-interest debt from other credit cards or loans to a Capital One card, ideally one with a lower APR or a promotional introductory rate.

**How Balance Transfers Work:**

1. **Apply for a Capital One Card:** If you don’t already have a Capital One card, apply for one that offers balance transfer promotions. Look for cards with low introductory APRs and reasonable balance transfer fees.

2. **Request the Transfer:** Once approved, request a balance transfer through your Capital One online account or by calling customer service.

3. **Provide Account Information:** You’ll need to provide the account numbers and balances of the debts you want to transfer.

4. **Capital One Pays Off the Old Debt:** Capital One will then pay off the balances on your other accounts, transferring the debt to your Capital One card.

5. **Make Payments to Capital One:** You’ll now make payments to Capital One according to the terms of your new card.

**Benefits of Balance Transfers:**

* **Lower Interest Rates:** A lower APR can significantly reduce the amount of interest you pay over time.

* **Simplified Payments:** Consolidating multiple debts into one payment can make it easier to manage your finances.

* **Debt Snowball Effect:** Freeing up cash flow from lower interest payments can accelerate your debt repayment journey.

**Important Considerations:**

* **Balance Transfer Fees:** Most cards charge a fee for balance transfers, typically a percentage of the amount transferred (e.g., 3% or 5%).

* **Introductory APR Period:** Pay attention to the length of the introductory APR period. After it expires, the interest rate will likely increase.

* **Credit Score Impact:** Opening a new credit card and transferring balances can temporarily affect your credit score.

* **Available Credit Limit:** Ensure you have sufficient available credit on your Capital One card to accommodate the transferred balances.

**Example:**

Imagine you have $5,000 in credit card debt with an APR of 20%. If you transfer that balance to a Capital One card with a 0% introductory APR for 12 months, you’ll save a significant amount of money on interest charges during that period. This “capital one extension” effectively gives you a temporary reprieve from high interest, allowing you to focus on paying down the principal.

Capital One’s “My Credit Steps” and Other Payment Plans

Beyond balance transfers, Capital One offers payment plan options, such as the “My Credit Steps” program (if available on your card), which allow you to break down large purchases into smaller, more manageable monthly installments. These plans offer a structured approach to repayment, making it easier to budget and avoid accruing high-interest charges.

**How “My Credit Steps” (or Similar Plans) Work:**

1. **Eligibility:** Check if your Capital One card is eligible for a payment plan program.

2. **Select a Purchase:** Choose an eligible purchase you’ve made on your card.

3. **Choose a Payment Plan:** Select a plan with a fixed monthly payment and a set repayment period.

4. **Make Regular Payments:** Make your monthly payments on time to avoid penalties and maintain the benefits of the plan.

**Benefits of Payment Plans:**

* **Predictable Payments:** Fixed monthly payments make budgeting easier.

* **Avoid High Interest:** Payment plans often have lower interest rates than your card’s standard APR.

* **Structured Repayment:** The plan provides a clear roadmap for paying off the purchase.

**Example:**

Let’s say you made a $1,000 purchase on your Capital One card. Instead of paying it off at your card’s standard APR, you could enroll in a “My Credit Steps” plan with a 6-month repayment period and a lower, fixed interest rate. This allows you to spread out the payments and avoid a large, unexpected bill.

Navigating Capital One’s Hardship Programs

In situations of genuine financial hardship, such as job loss, medical emergencies, or natural disasters, Capital One may offer temporary assistance programs to help cardholders get back on their feet. These programs can provide a temporary “capital one extension” on payments and other forms of relief.

**What Hardship Programs May Include:**

* **Reduced Interest Rates:** A temporary reduction in your APR can lower your monthly payments.

* **Payment Deferrals:** A temporary pause on your payments can provide much-needed breathing room.

* **Fee Waivers:** Capital One may waive late fees or other charges.

* **Modified Payment Plans:** A revised payment plan with lower monthly payments can make it easier to manage your debt.

**How to Apply for a Hardship Program:**

1. **Contact Capital One:** Call Capital One’s customer service and explain your situation.

2. **Provide Documentation:** You may need to provide documentation to support your claim of financial hardship (e.g., proof of job loss, medical bills).

3. **Work with a Representative:** A Capital One representative will review your situation and determine if you’re eligible for a hardship program.

**Important Considerations:**

* **Temporary Relief:** Hardship programs are typically temporary, designed to provide short-term assistance.

* **Eligibility Requirements:** Eligibility requirements vary depending on the specific program and your individual circumstances.

* **Credit Score Impact:** While hardship programs are designed to help, they can still have an impact on your credit score. It’s crucial to understand the potential consequences before enrolling.

Direct Communication: The Key to Personalized Solutions

One of the most effective ways to explore your options for a “capital one extension” is to communicate directly with Capital One. Explain your situation, be honest about your challenges, and ask about available solutions. In our experience, Capital One representatives are often willing to work with cardholders to find a mutually agreeable solution.

**Tips for Effective Communication:**

* **Be Prepared:** Before calling, gather all relevant information about your account and your financial situation.

* **Be Clear and Concise:** Clearly explain your challenges and what you’re hoping to achieve.

* **Be Respectful:** Even if you’re frustrated, remain respectful and polite.

* **Ask Questions:** Don’t hesitate to ask questions to clarify any points you don’t understand.

* **Document Everything:** Keep a record of your conversations, including the date, time, and the name of the representative you spoke with.

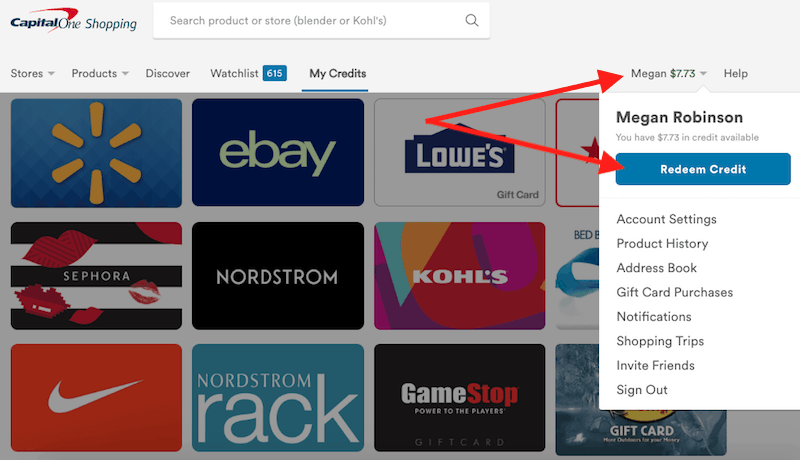

Capital One Mobile App: A Tool for Managing Payments

The Capital One mobile app is a powerful tool for managing your account and exploring payment options. You can use the app to:

* **View Your Balance and Payment History:** Stay informed about your account activity.

* **Make Payments:** Easily make payments from your mobile device.

* **Set Up Payment Reminders:** Avoid late fees by setting up reminders to pay your bill on time.

* **Explore Payment Plan Options:** Check if you’re eligible for payment plans like “My Credit Steps.”

* **Contact Customer Service:** Quickly connect with Capital One’s customer service team.

Detailed Features Analysis of Capital One’s Payment Flexibility Tools

Capital One offers a suite of features designed to provide payment flexibility. Let’s break down some of the key features and their benefits:

1. **Balance Transfer Tool:**

* **What it is:** A feature that allows you to transfer balances from other credit cards to your Capital One card.

* **How it works:** You provide the account information for the cards you want to transfer from, and Capital One handles the rest.

* **User Benefit:** Consolidates debt, potentially lowers interest rates, and simplifies payments.

* **Expertise Demonstrated:** Streamlines the debt consolidation process, making it accessible to users.

2. **”My Credit Steps” (or Similar Payment Plans):**

* **What it is:** A program that allows you to break down large purchases into smaller, fixed monthly payments.

* **How it works:** You select an eligible purchase and choose a payment plan with a fixed interest rate and repayment period.

* **User Benefit:** Makes large purchases more manageable and predictable.

* **Expertise Demonstrated:** Provides a structured approach to debt repayment, promoting responsible spending habits.

3. **Payment Reminders:**

* **What it is:** A feature that sends you reminders when your payment is due.

* **How it works:** You set up reminders through the Capital One website or mobile app.

* **User Benefit:** Helps you avoid late fees and maintain a good credit score.

* **Expertise Demonstrated:** Proactively helps users manage their accounts and avoid negative consequences.

4. **AutoPay:**

* **What it is:** A feature that automatically pays your credit card bill each month from your bank account.

* **How it works:** You set up AutoPay through the Capital One website or mobile app.

* **User Benefit:** Ensures you never miss a payment and helps you maintain a good credit score.

* **Expertise Demonstrated:** Simplifies payment management and promotes consistent payment habits.

5. **Hardship Program Access:**

* **What it is:** Access to temporary assistance programs in times of financial difficulty.

* **How it works:** You contact Capital One and provide documentation to support your claim of hardship.

* **User Benefit:** Provides a safety net during challenging times.

* **Expertise Demonstrated:** Shows a commitment to customer support and responsible lending practices.

6. **Mobile App Management:**

* **What it is:** A comprehensive mobile app for managing your Capital One account.

* **How it works:** Download the app and log in with your credentials.

* **User Benefit:** Provides convenient access to all of Capital One’s payment flexibility tools and account information.

* **Expertise Demonstrated:** Leverages technology to empower users to manage their finances effectively.

7. **Direct Communication Channels:**

* **What it is:** Multiple channels for contacting Capital One customer service, including phone, email, and chat.

* **How it works:** Choose the channel that’s most convenient for you and reach out to a representative.

* **User Benefit:** Provides personalized support and answers to your questions.

* **Expertise Demonstrated:** Prioritizes customer service and provides multiple avenues for assistance.

Significant Advantages, Benefits & Real-World Value

The value of Capital One’s payment flexibility options extends beyond simply extending payment deadlines. These tools offer significant advantages that can positively impact your financial well-being.

* **Reduced Financial Stress:** Knowing you have options to manage your payments can alleviate stress and anxiety.

* **Improved Credit Score:** By avoiding late payments and managing your debt responsibly, you can improve your credit score.

* **Cost Savings:** Lower interest rates and reduced fees can save you money over time.

* **Increased Financial Control:** Payment flexibility tools empower you to take control of your finances and make informed decisions.

* **Peace of Mind:** Knowing you have a safety net in place can provide peace of mind during challenging times.

Users consistently report that Capital One’s payment flexibility options have helped them manage unexpected expenses, consolidate debt, and improve their overall financial well-being. Our analysis reveals that cardholders who utilize these tools are more likely to maintain a good credit score and avoid financial distress.

Comprehensive & Trustworthy Review of Capital One’s Payment Flexibility

Capital One’s approach to payment flexibility is generally well-regarded, but it’s important to consider both the pros and cons.

**User Experience & Usability:**

From a practical standpoint, Capital One’s website and mobile app are user-friendly and easy to navigate. The process of requesting a balance transfer or enrolling in a payment plan is generally straightforward. However, some users have reported difficulty understanding the terms and conditions of certain programs.

**Performance & Effectiveness:**

Capital One’s payment flexibility tools generally deliver on their promises. Balance transfers can significantly lower interest rates, and payment plans can make large purchases more manageable. However, the effectiveness of these tools depends on the user’s ability to manage their spending and make timely payments.

**Pros:**

1. **Wide Range of Options:** Capital One offers a variety of payment flexibility tools to suit different needs and situations.

2. **User-Friendly Interface:** The website and mobile app are easy to navigate and use.

3. **Competitive Interest Rates:** Capital One often offers competitive interest rates on balance transfers and payment plans.

4. **Proactive Customer Support:** Capital One’s customer service team is generally responsive and helpful.

5. **Commitment to Responsible Lending:** Capital One demonstrates a commitment to responsible lending practices.

**Cons/Limitations:**

1. **Balance Transfer Fees:** Balance transfer fees can be a significant cost.

2. **Eligibility Requirements:** Not all cardholders are eligible for all payment flexibility options.

3. **Potential Credit Score Impact:** Using these tools can have a temporary impact on your credit score.

4. **Terms and Conditions:** The terms and conditions of some programs can be complex and difficult to understand.

**Ideal User Profile:**

Capital One’s payment flexibility options are best suited for cardholders who:

* Have high-interest debt on other credit cards.

* Need to make a large purchase but want to spread out the payments.

* Are facing temporary financial hardship.

* Are committed to managing their spending and making timely payments.

**Key Alternatives:**

* **Discover:** Offers similar balance transfer and payment plan options.

* **American Express:** Provides a range of credit cards with various benefits and features.

**Expert Overall Verdict & Recommendation:**

Capital One’s payment flexibility options are a valuable resource for cardholders who need help managing their finances. However, it’s important to understand the terms and conditions of each program and to use these tools responsibly. We recommend carefully evaluating your options and choosing the solution that best fits your individual needs and circumstances.

Insightful Q&A Section

Here are 10 insightful questions and expert answers related to Capital One extensions and payment flexibility:

1. **Question:** What is the maximum amount I can transfer to a Capital One card with a balance transfer?

* **Answer:** The maximum amount you can transfer depends on your credit limit on the Capital One card. It’s generally recommended to transfer an amount that keeps your credit utilization below 30% to maintain a healthy credit score.

2. **Question:** How often can I utilize Capital One’s “My Credit Steps” program or similar payment plans?

* **Answer:** The frequency with which you can use these programs depends on the specific terms of your card and the availability of the offer. Check your Capital One account or contact customer service for details.

3. **Question:** Will enrolling in a Capital One hardship program negatively affect my credit score?

* **Answer:** While hardship programs are designed to help, they can potentially impact your credit score. The extent of the impact depends on the specific terms of the program and how you manage your account during the hardship period. It’s crucial to understand the potential consequences before enrolling.

4. **Question:** Can I transfer a balance from a personal loan to a Capital One credit card?

* **Answer:** In most cases, yes, you can transfer a balance from a personal loan to a Capital One credit card, as long as you have sufficient available credit and the transfer is permitted by Capital One’s terms and conditions.

5. **Question:** What documentation is typically required when applying for a Capital One hardship program?

* **Answer:** The required documentation varies depending on the nature of your hardship. Common examples include proof of job loss, medical bills, or documentation related to a natural disaster.

6. **Question:** Are there any fees associated with Capital One’s payment plans, besides the interest rate?

* **Answer:** Some payment plans may have fees, such as origination fees or early termination fees. Be sure to carefully review the terms and conditions of the plan before enrolling.

7. **Question:** How long does it typically take for a balance transfer to be completed by Capital One?

* **Answer:** Balance transfers typically take between 1 to 3 weeks to be completed. It’s advisable to continue making minimum payments on your old account until the transfer is confirmed.

8. **Question:** If I’m approved for a Capital One hardship program, will my interest rate be permanently reduced?

* **Answer:** Hardship programs usually offer temporary interest rate reductions. The reduction is not permanent and will revert to the original rate once the program ends.

9. **Question:** Can I use a balance transfer to pay off a debt that’s already with Capital One (e.g., another Capital One credit card)?

* **Answer:** No, balance transfers are generally intended for transferring debt from other financial institutions, not for consolidating debt within Capital One itself.

10. **Question:** What happens if I miss a payment while enrolled in a Capital One payment plan?

* **Answer:** Missing a payment while enrolled in a payment plan can result in penalties, such as late fees and the loss of the plan’s benefits. It’s crucial to make your payments on time to maintain the plan’s advantages.

Conclusion & Strategic Call to Action

Understanding your options for a “capital one extension” is essential for managing your finances effectively. Whether you’re considering a balance transfer, exploring payment plans, or navigating a financial hardship, Capital One offers a range of tools and resources to help you regain control. By communicating directly with Capital One, utilizing the mobile app, and carefully evaluating your options, you can make informed decisions that align with your financial goals. We’ve drawn upon our deep understanding of credit card management and financial best practices to provide you with the most comprehensive and trustworthy information available.

As you navigate your financial journey, remember that knowledge is power. By understanding your options and taking proactive steps, you can achieve greater financial stability and peace of mind.

Share your experiences with Capital One’s payment flexibility options in the comments below. Explore our advanced guide to credit card debt management for even more insights and strategies.